💸🏴Once upon a time—not in some utopian fantasy, but in 1970s Britain—the nation actually owned things. The water flowing through your taps, the buses and trains you caught to work, the mail that dropped on your doorstep, the energy that lit your home, and millions of council houses built for ordinary people. Add to that a juicy cushion of North Sea oil and gas reserves. The country had assets. It had leverage. It had a shot. And the national debt? A manageable £80 billion.

Fast-forward to 2022: Britain owns nothing, rents everything, and owes a gut-punching £2.5 trillion. That’s trillion with a “T”—as in Titanic disaster, only this ship was deliberately steered into the iceberg by politicians clutching champagne glasses and calling it “modernisation.”

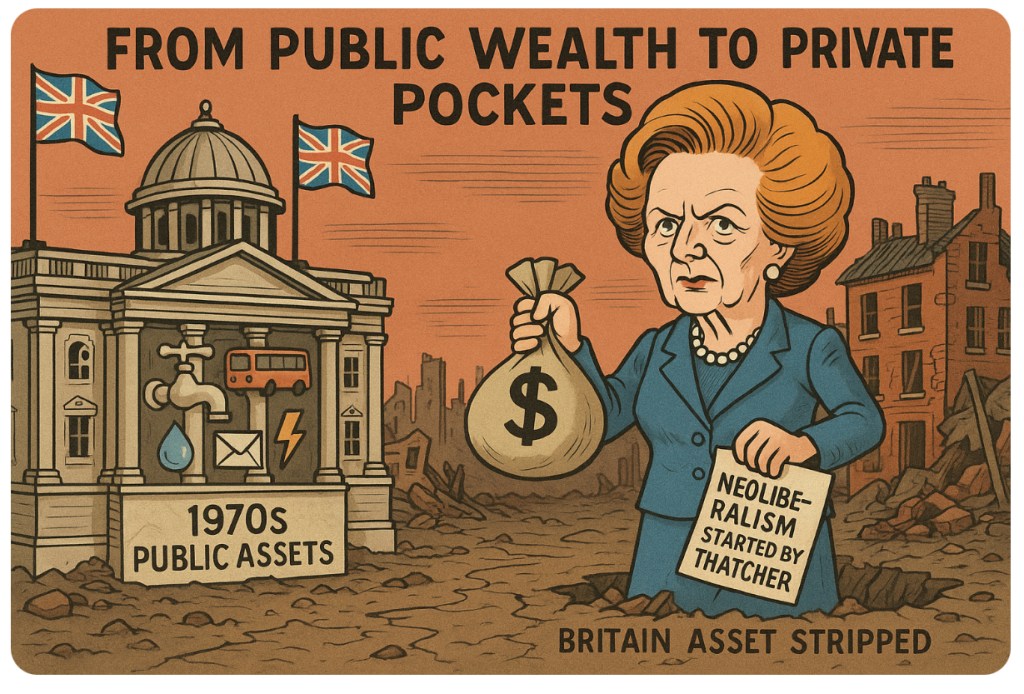

🧨 The Thatcherite Fire Sale

Enter Margaret Thatcher with her handbag and her holy grail of “neoliberalism.” Translation: sell off every public asset you can find to private bidders, dress it up as efficiency, and call it progress. Water, rail, energy, housing—gone. Once the backbone of national security and independence, flogged off to corporate interests at bargain-basement prices.

It was the biggest garage sale in history, except the garage was the British state, and the family silver wasn’t sold to cover rent—it was dumped on the neighbours while politicians cheered about “the free market.” Now, we pay through the nose for services we already built and owned. Water bills skyrocket, trains are late and overpriced, housing is a financial trap, and energy companies rake in record profits while pensioners freeze.

Neoliberalism wasn’t a philosophy—it was a smash-and-grab raid dressed in a suit.

🏚️ Britain: Asset Stripped Nation

Today, Britain has “no assets,” as the meme bluntly points out. The public once had shared wealth; now, we’ve got hollowed-out services and an eye-watering debt mountain. Imagine selling your car, house, and tools, then still maxing out every credit card. That’s Britain’s economic model. The money didn’t vanish—it got siphoned upward, into the hands of private shareholders, offshore hedge funds, and foreign conglomerates.

The cruel irony? Thatcher promised home ownership and prosperity. Instead, millions are trapped in a rigged housing market, council housing stock is decimated, and the young face rent that swallows half their income. Energy prices surge while oil and gas companies report record profits. Rail fares rise faster than wages, yet you’re lucky if the train even shows up.

This isn’t just bad policy—it’s a con. A carefully engineered transfer of wealth from public hands into private coffers, blessed by every government since, red or blue.

🦴 From Lion to Lapdog

In the 1970s, Britain was no paradise—let’s not romanticise it—but it was a nation with assets and control. Today, it’s a neoliberal cautionary tale: asset-stripped, debt-soaked, and politically gaslit into thinking “there is no alternative.” Thatcher’s mantra of TINA (There Is No Alternative) was less an argument and more a threat: accept your fleecing, or else.

And what do we have to show for it? Crumbling infrastructure, broken services, generational poverty, and the bitter knowledge that when the state could have invested in people, it instead auctioned them off to the highest bidder.

🔥 Challenges 🔥

How long do we keep swallowing the myth that selling public wealth makes us richer? Why do we let politicians spin “privatisation” as progress when all it’s done is balloon debt and gut our services? Are we really supposed to believe the UK is “broke” while private companies gorge on the very assets we once collectively owned?

Drop your outrage, your satire, your sharpest critiques in the comments below. We want your fire. 🔥💬

👇 Hit comment, hit like, hit share. Let’s torch the fairy tale of neoliberal success and call it what it is: Britain’s great robbery.

The best burns, rants, and reality checks will be featured in the magazine. 🎤💥

Leave a comment