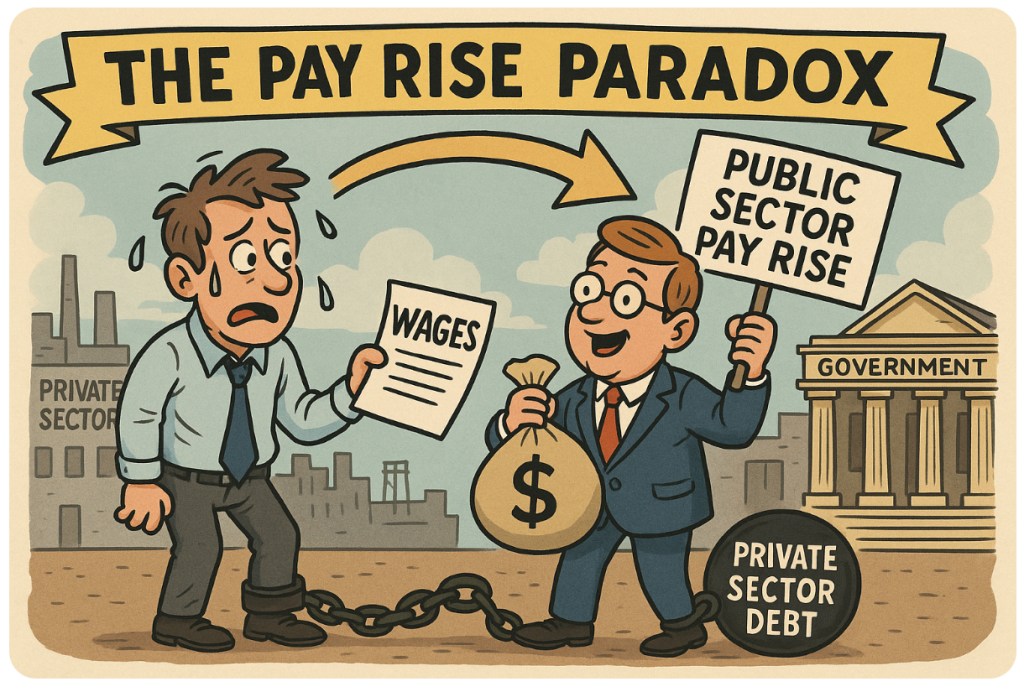

💰⚖️ It’s the economic magic trick no one asked for: governments boasting about wage growth while the private sector quietly holds its breath. Public service workers—from administrators to healthcare staff—are getting well-earned pay bumps. Meanwhile, private companies are whispering “we can’t match that” as they cling to survival in an economy that’s already creaking under the weight of inflation, debt, and dwindling productivity.

The irony? Every public sector pound comes from the private sector’s pocket. It’s not cruel economics—it’s just arithmetic. When private business stalls but government pay keeps climbing, someone has to pick up the tab. Spoiler: it’s you.

🧾 The Great Economic Self-Eating Snake

Imagine a giant ouroboros—an economy eating its own tail. The public sector depends on taxes from private enterprise. But when private sector wages stagnate, tax receipts flatten. To keep promises of public pay rises, governments reach for the debt lever.

And so begins the loop:

- Borrow money to fund higher public wages.

- Service that debt with future taxes (and even more borrowing).

- Hope the private sector eventually earns enough to catch up.

But it doesn’t. Not because it’s lazy, but because high costs, regulation, and shrinking profit margins leave little room for wage growth. It’s a closed circuit of good intentions and bad economics.

Think of it this way: the government’s giving itself a raise with your overdraft. It looks generous in the short term but quietly fuels long-term inflation, higher interest rates, and debt ceilings that make Everest look manageable.

🧮 Public vs. Private: The Great Divide

In theory, public pay rises help boost morale, productivity, and retention in critical services like healthcare and education. And that’s fair. But when the private sector can’t afford to mirror those increases, the workforce divides into two realities:

- Public sector employees with guaranteed raises, pensions, and job stability.

- Private sector workers facing tighter margins, layoffs, and real-term pay cuts.

That imbalance doesn’t just breed resentment—it strangles growth. Small businesses can’t hire, consumers stop spending, and governments compensate by… borrowing more. The snake eats another chunk of its tail.

Meanwhile, politicians sell this cycle as “supporting working families.” Translation: “We’re buying votes with borrowed money.”

🧨 The Debt Threshold Dilemma

Here’s where it gets truly dangerous: every time a government borrows to cover payroll instead of investing in productivity, it mortgages the future. Debt servicing—interest payments alone—becomes a major line item in the national budget. That’s money not going into infrastructure, innovation, or small business support.

In essence, we’re spending tomorrow’s prosperity to pay today’s salaries. And when tomorrow comes, there’s nothing left but another loan.

Economists call it “fiscal imbalance.” The rest of us call it “a slow-motion car crash.”

🔥 Challenges 🔥

Is this sustainable—or are we just inflating a bubble of borrowed comfort? 🧨

Should governments tie wage growth to private sector performance? Or do public workers deserve more, no matter the macroeconomics?

💬 Jump into the comments—especially if you’ve got firsthand experience from either side of the divide.

👍 Like, share, and tag that one economist friend who insists “debt doesn’t matter.”

The sharpest takes, fiercest arguments, and smartest insights will be featured in the next issue of the magazine. 🧠💥

Leave a comment