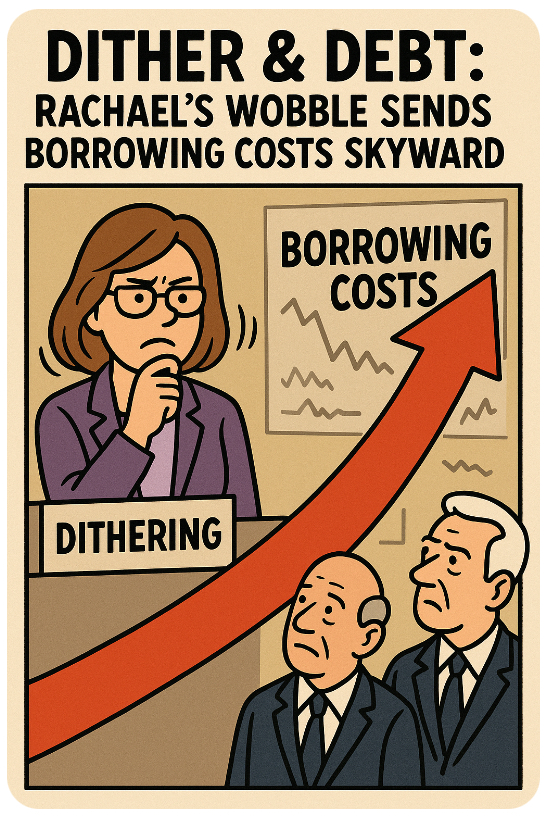

📉💷⏳While Rachael—presumably clutching a stack of unread briefing notes—paces indecisively through Westminster, the bond markets have heard enough. The cost of government borrowing is up, and it’s not because of some grand economic shock. No, it’s because Rachael is dithering like someone trying to choose a meal deal while the shop burns down. 🔥🥪

🏦 Markets Don’t Like Maybes, Rachael

Investors are a cold-blooded bunch. They don’t care if Rachael needs “more time to weigh options” or if she’s in a three-week mindfulness retreat with a spreadsheet. They see hesitation as weakness, and weakness costs money—taxpayer money.

Now, instead of stability, we get premium-priced government debt. Like taking out a payday loan because the Chancellor couldn’t decide between “Plan A” or “maybe Plan B but also Plan C, with a side of wait-and-see.” And who pays the price? Not Rachael. Not the dithering class. You. Me. The nation. In higher interest rates, squeezed services, and a fresh excuse to slash school budgets again.

But don’t worry—Rachael’s statement is definitely coming… next quarter. Or after the committee reviews. Or once Mercury’s out of retrograde. Maybe.

🔥 Challenges 🔥

Why is the cost of dithering measured in billions? Why are leaders allowed to stall when the markets move faster than a Black Friday stampede?

We want your best takedowns, economic metaphors, and policy rants in the blog comments. 💬📈

👇 Comment, like, and share if you’re sick of indecisive leadership costing the country.

Top comments get immortalised in the next issue of the magazine. 📰💥

Leave a comment