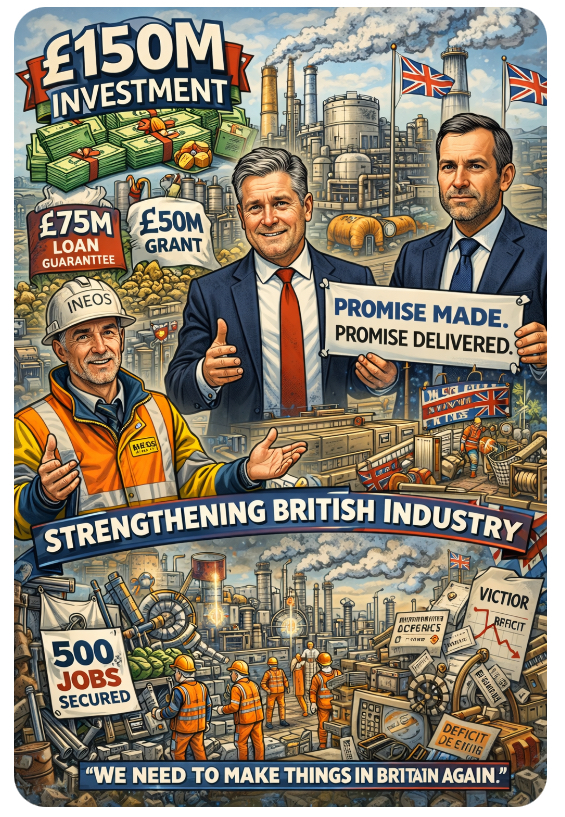

🏭🇬🇧In a country where factories vanish faster than political promises, INEOS dropping £150 million on Grangemouth feels almost rebellious. Even more shocking? The UK Government actually showed up—with a £75m loan guarantee, a £50m grant, and a sudden rediscovery that making things might matter after all. At a time when British manufacturing has been quietly marched to the exit, this deal screams one thing: industrial panic meets overdue realism.

🔧 Not Deindustrialisation With a Green Bow on It

Sir Jim Ratcliffe didn’t mince his words—and thank goodness for that. This isn’t a cuddly net-zero fairy tale. This is survival. Grangemouth isn’t some nostalgic smokestack—it’s a strategic backbone supplying everything from food packaging and medicines to insulation and automotive parts. You don’t get a “modern economy” without boring, unglamorous, high-energy industry humming in the background.

And yet, for years, policy has behaved as if you can regulate, tax, and carbon-price manufacturing into extinction—then magically import the same products from overseas and call it progress. Spoiler: it’s not cleaner, it’s not cheaper, and it certainly isn’t sovereign.

So yes, the investment improves efficiency and reduces emissions—but crucially, it keeps the lights on. Over 500 high-value jobs protected. Hundreds more in supply chains secured. Industrial capability preserved. That’s not ideology—that’s triage. 🩺⚙️

Keir Starmer calls it “promise made, promise delivered.” Fine. But let’s be honest: this is less a victory lap and more a late intervention. Two-thirds of British manufacturing has vanished in 25 years. The population has grown by 10 million. Demand hasn’t gone anywhere—only the factories have.

🔥 Challenges 🔥

Here’s the uncomfortable question politicians keep dodging: how many Grangemouths are left? And how many will quietly die before Westminster realises you can’t run a G7 economy on imports, slogans, and service jobs alone?

Is this the start of a genuine industrial reset—or just emergency spending to stop another strategic asset from collapsing on someone’s watch? Get into it. Argue it out properly in the blog comments, not drive-by reactions on social media. 💬🏭

👇 Like it. Share it. Challenge it.

The sharpest comments and strongest arguments will be featured in the next issue of the magazine. 📰🔥

Leave a comment