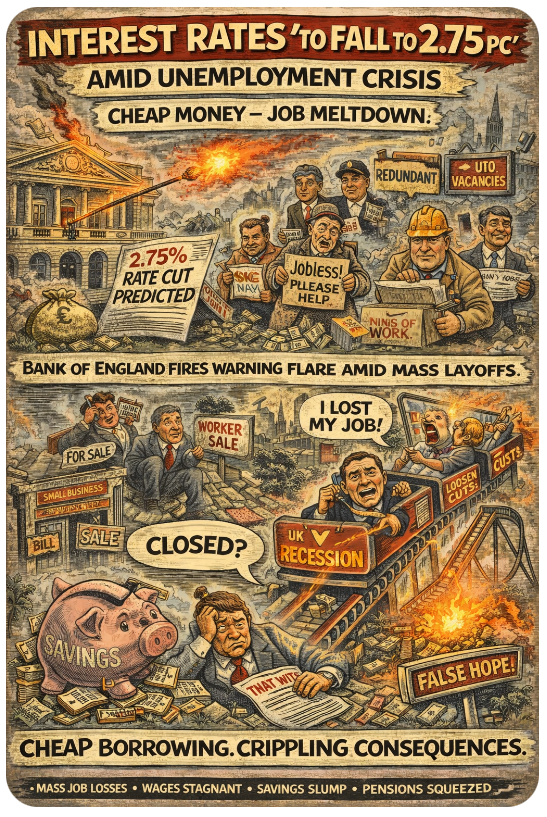

📉🧨Interest rates are forecast to tumble to 2.75%, not because the economy is healing — but because it’s bleeding out. A Swiss lender is calling it now: the Bank of England won’t cut rates to be generous — it’ll cut because the job market is imploding, and drastic damage control is the only option left.

💷 Cheaper Borrowing. Pricier Consequences.

Lower rates sound dreamy if you’re holding a mortgage, but don’t let the headlines fool you — this is no victory lap.

We’re not talking about soft landings or economic “rebalancing.”

We’re talking mass layoffs, vanishing vacancies, and a government praying that cheaper money distracts us from the burning wreckage of employment.

Unemployment is the engine behind this shift — not growth. Not productivity. Not resilience. Just the grim thud of businesses shedding staff, industries flatlining, and consumer confidence collapsing faster than a Sunak soundbite.

And what happens when rates drop like this?

- 🚪People stop spending because they’ve lost their income.

- 🏚️ Small businesses fold before they can benefit from cheaper loans.

- 💼 Jobseekers face a market with fewer doors and lower pay.

- 💸 Savers? Punished. Pensions? Squeezed. Safety nets? Shredded.

This is triage economics — not recovery. And no one should celebrate it.

🔥 Challenges 🔥

Where does this really lead us? Can we cut rates and still pretend we’re not in a crisis? Or is the UK walking blindly into another lost decade of wage stagnation and underemployment?

💬 Drop your thoughts in the blog comments.

Will this help you or hurt you? Will it stimulate jobs — or just sedate headlines?

👇 COMMENT. LIKE. SHARE.

Tell us what falling rates really mean on the ground floor of your life.

Top takes will be featured in the next issue of the magazine. 🗞️📢

Leave a comment