Nigel Farage says it’s Europe’s fault. Banks say it’s compliance. We say it’s a financial exorcism gone corporate.

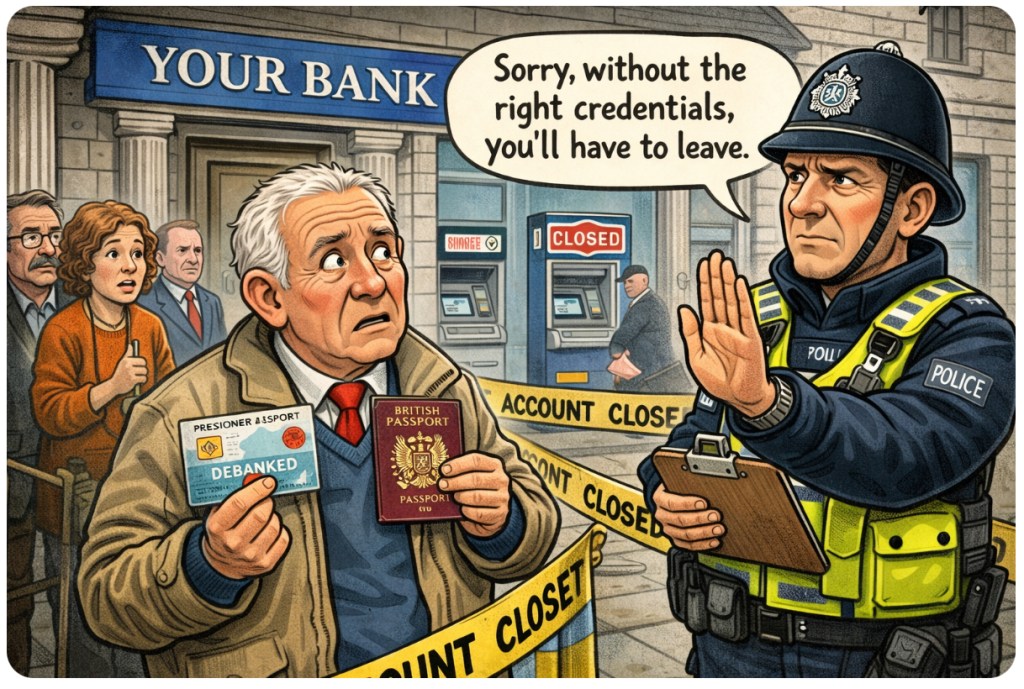

🚫 The Great British Account Cull – Now With Extra Bureaucracy

Yes, you heard right. Over 500,000 UK bank accounts were closed in a single year — the kind of number that sounds like a cyberattack but is, in fact, just everyday British banking under “tightened regulation.” You know, the kind that protects nobody and affects everybody. 🧾💥

Nigel Farage, man of the pint and perpetual grievance, has declared it “appalling” and blamed EU-style financial rules. The irony? We left the EU but somehow kept their most annoying paperwork. It’s like leaving a toxic relationship and still mowing their lawn. 🇬🇧➡️📉

This isn’t about fraud or crime. These closures hit small businesses, charities, people with “unusual” names, and anyone the algorithm found mildly inconvenient. Got flagged? Good luck arguing with an HSBC chatbot powered by a soggy spreadsheet and fear of fines.

You want a mortgage? Start by explaining that meme you posted in 2017.

Trying to open a charity account? Better hope your donors didn’t once use a VPN.

Selling novelty mugs online? Sorry, you’re “high risk.”

Farage may not be everyone’s cup of Brexit, but here’s the brutal truth: today it’s political figures. Tomorrow it’s you for making a bank transfer at 3 a.m. after watching a YouTube conspiracy about pensions. 💳👀

The financial system isn’t just debanking — it’s de-peopling. Sanitising itself like it’s prepping for a dinner party hosted by the FCA.

Meanwhile, real fraudsters? They’re sipping cocktails in the Caymans under six fake names and a shell company that owns five more.

🧨 Challenges 🧨

Half a million accounts shut — and barely a ripple in the press.

Why aren’t we rioting in the comments?

Ever been debanked, declined, or digitally ghosted by your bank? Share your horror stories, sarcasm, or both. 💬🧾

Leave a comment