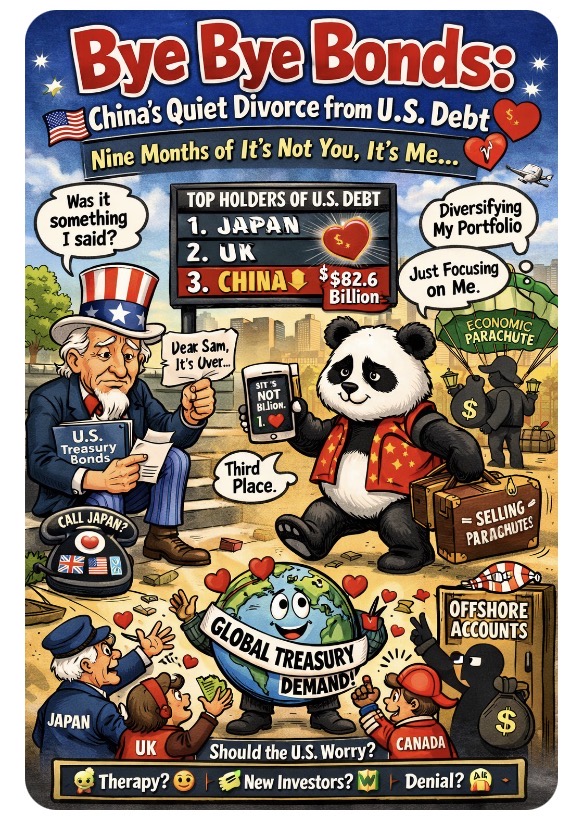

China keeps slowly ghosting U.S. Treasury bonds—and while it’s not exactly a Vegas-style breakup, it is the financial equivalent of texting “it’s not you, it’s me” for nine straight months.

🥢 The Great Treasury Diet: Why China’s Slimming Down on U.S. IOUs

Let’s paint the picture: China once cuddled up to over $1.3 trillion in U.S. government debt like it was a heated blanket made of Benjamins. Now? That warm embrace has cooled to a chilly $682.6 billion, and the trend is looking less “temporary belt-tightening” and more “permanent breakup with interest.”

For nine straight months—yes, nine—China has been quietly offloading Treasuries like last season’s fashion. And while some Wall Street whisperers say “don’t panic,” the vibe shift is real. Once the top holder, China’s now chilling in third place behind Japan and the UK, like a former valedictorian watching someone else get their name called at graduation.

But don’t cue the funeral dirge for U.S. debt just yet. Uncle Sam’s Treasuries are still the prom queen of global finance, with plenty of suitors lining up (Japan, the UK, Canada—basically the G7 version of thirsty DMs). In fact, foreign holdings overall are at record highs, which begs the question: is China just being moody, strategic, or quietly packing its economic parachute?

Analysts love to muddy the waters, noting that sales might be hidden behind custodians and offshore shell games, so China might be sipping tea while everyone else tries to decode the smoke signals. Whatever the reason, the message is clear: the world’s second-biggest economy isn’t betting as hard on Washington’s credit score anymore.

So what does it mean? Are we witnessing financial strategy or economic shade? Is China diversifying like a good portfolio manager, or is this the geopolitical version of “I’m just focusing on myself right now”? Whatever it is, it’s deliberate. And deliberate is loud—even when it whispers.

🔥 Challenges 🔥

How should the U.S. react to China’s bond breakup—therapy, denial, or finding a rebound investor with better rates? Should Americans care that the Treasury’s old flame is slowly backing out the door, or is this just global economics doing its thing?

Leave a comment