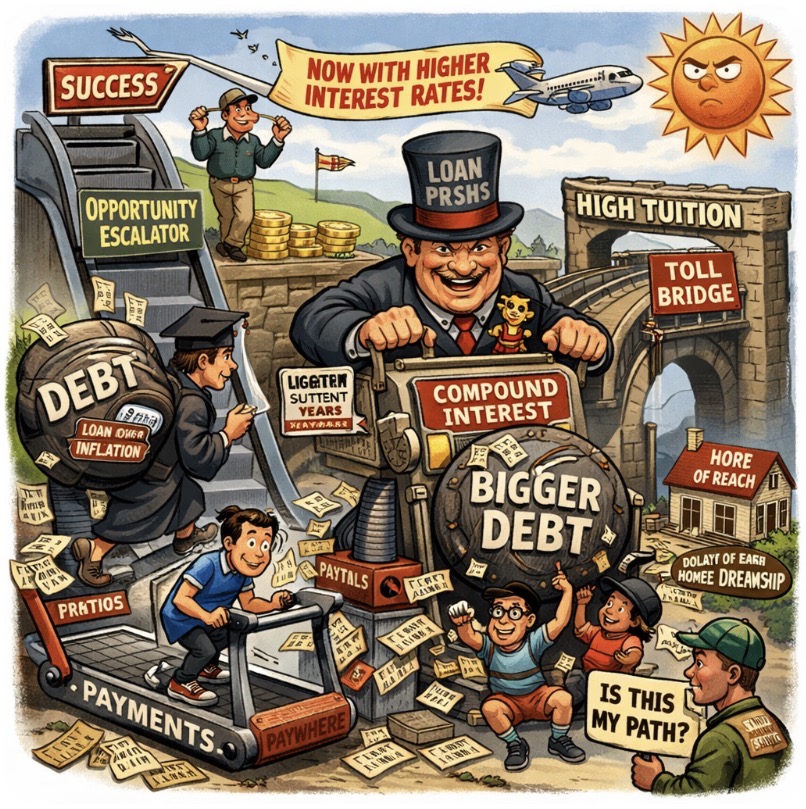

🎓💸🔥Higher education was sold as the golden escalator 🚀 — step on, work hard, rise up. A shared investment between state and student. Society wins. You win. Everyone claps politely at graduation.

But when student loan interest rates sprint ahead of inflation like they’re training for the Financial Olympics 🏃♂️📈, that escalator starts moving backwards.

The promise was simple: borrow now, repay fairly later.

The reality? Repay while your balance quietly fattens itself in the background like a hedge fund with a caffeine addiction.

Suddenly, the question isn’t “Is university worth it?”

It’s “Is this a degree… or a 30-year subscription to compounding anxiety?” 😬

📊 The Compounding Plot Twist Nobody Put in the Prospectus

Let’s unpack the polite fiction.

Student finance was framed as a social contract:

You earn more → you contribute more.

You earn less → you repay less.

Progressive. Civilised. Sensible.

But here’s where the arithmetic gets spicy 🌶️.

If interest grows at twice the rate of inflation, your debt isn’t just sitting there waiting patiently. It’s doing push-ups. It’s networking. It’s expanding in real terms. For many graduates, the early years of repayment look like financial treadmill training: steady payments, balance still rising. 🏋️♀️

That changes behaviour.

An 18-year-old weighing university doesn’t think in macroeconomic redistribution theory. They think in projected liability. In “Will this follow me into my thirties?” In “What happens if my salary stalls?” In “Why does this look like a gym membership I can’t cancel?”

And here’s the quiet shift:

When interest rates float far above inflation, repayment starts to feel less like cost-sharing and more like revenue extraction.

Supporters will argue the system remains income-contingent. That it’s progressive. That high earners pay more. And yes — structurally, that’s true.

But perception is policy’s shadow. 👥

If debt grows faster than the cost of living, the subsidy becomes invisible. What remains visible is the swelling number at the bottom of a statement.

For wealthier families, that number feels abstract — almost theatrical.

For lower-income students, it feels like risk exposure.

And risk changes participation.

The system designed to widen access begins whispering doubt instead of reassurance. The bridge starts to resemble a toll road.

Meanwhile, there’s another tension simmering beneath the surface:

If graduates repay with high interest, what signal does that send to those who choose vocational paths? Is higher education a public investment — or a premium product with state-backed financing?

Because the difference matters.

If contribution becomes indistinguishable from profit, trust erodes. And trust is the true currency of long-term policy.

This isn’t just about numbers. It’s about signal. 📡

An interest rate above inflation tells young people something subtle but powerful:

Educational debt is treated differently from other forms of social investment. Opportunity accrues cost over time. Even when the economy doesn’t justify it.

And that signal compounds.

Graduates delay homes. Delay businesses. Delay families. Even with income-contingent repayments, the psychological presence of expanding debt shapes decisions in quiet, generational ways.

Over decades, that shapes wealth patterns. Stability patterns. Confidence patterns.

The original promise was widening access while sharing cost.

If interest outpaces inflation significantly, the system risks morphing into something else entirely — a deterrent disguised as a bridge.

So the question isn’t whether graduates should contribute.

It’s whether the model still reflects its founding logic.

Because once confidence slips, participation follows.

And once participation shifts, opportunity narrows.

And when opportunity narrows, the cost is no longer personal — it’s national.

🔥 Challenges 🔥

Are we still calling this a “shared investment” — or has it quietly become a long-term revenue stream? 🤔

Does high interest protect public finances… or does it discourage the very students the system was built to empower?

Drop your sharpest take in the blog comments (not just on social media 👀). Challenge the premise. Defend the structure. Tear it apart if you must.

👇 Comment. Like. Share. Start the debate where it belongs.

The most insightful, ruthless, or brilliantly argued responses will be featured in the next issue of the magazine. 📝🔥

Leave a comment