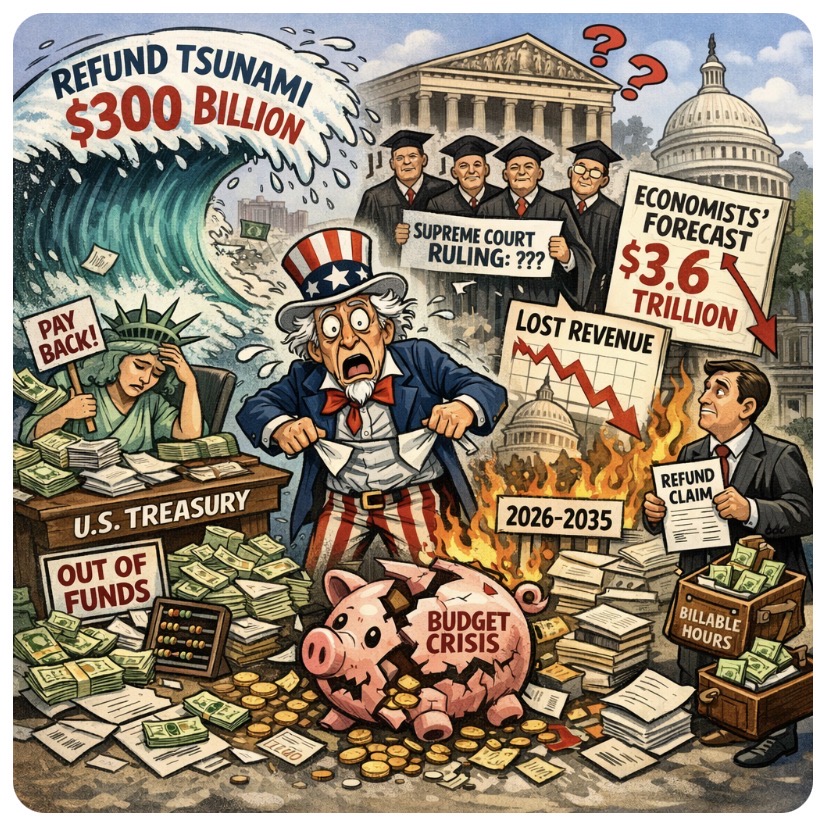

💸⚖️When courts start swinging gavels at sweeping tariff policies, the bill doesn’t just disappear—it boomerangs. And now, thanks to a landmark ruling that’s sent trade lawyers into overdrive, the U.S. Treasury may be staring down a refund tsunami measured not in millions… but in hundreds of billions. 🧾🌊

From potential repayments to importers to vanished future revenue streams, this isn’t just a legal technicality—it’s a fiscal plot twist worthy of a primetime drama.

💰 Refund Roulette: Who Ordered the $300 Billion Surprise?

Let’s break it down.

Analysts estimate that more than $175 billion in previously collected tariff revenue could now be subject to refund claims. Some economists and news reports whisper even bigger numbers—$240 to $300 billion—depending on 2025 collections and who qualifies for reimbursement.

That’s not a refund. That’s a federal-scale “oops.” 😬

And here’s the kicker: the Supreme Court ruling didn’t outline how refunds should actually be handled. So now we’ve got companies lining up, lawyers sharpening pencils, and a process that could take years to untangle in courtrooms across the country. ⚖️🐢

In other words, it’s not just expensive—it’s complicated.

Meanwhile, the Treasury may be forced to repay importers who already baked those tariffs into their pricing models. Picture accountants rubbing their temples while spreadsheets burst into flames. 📊🔥

📉 The Revenue That Got Away

Even before refund drama, the tariffs were a cash machine.

In 2025 alone, the disputed tariffs reportedly generated around $287 billion in revenue as rates jumped from roughly 2.5% to near historic highs. That’s not spare change—it’s budget-shaping money.

But wait, there’s more.

Some economists projected that if the broad tariff scheme had continued under the same legal theory, revenue from 2026–2035 could have reached as high as $3.6 trillion. Now, let’s be clear: those are projections tied to policy assumptions—not guaranteed cash.

Still, it’s the difference between planning a fiscal fireworks show 🎆 and finding out someone unplugged the power cord.

So the bottom line?

The U.S. Treasury could be:

- On the hook for hundreds of billions in repayments

- Missing out on massive projected future revenue

- Navigating years of legal uncertainty

Not exactly the kind of surprise you want in a federal budget spreadsheet.

🔥 Challenges 🔥

If tariffs were sold as “revenue engines,” what happens when the engine backfires? Should importers get every dollar back? Should Congress step in? And who ultimately pays when trade policy turns into legal limbo? 🤔

Drop your take in the blog comments (not just social media). Sound off on whether this is fiscal justice or financial chaos. 💬⚡

👇 Comment. Like. Share.

Bring your sharpest economic hot takes.

The best responses will be featured in the next issue of the magazine. 📰✨

Leave a comment